TERM LIFE INSURNCE

One of the most commonly used policies is term life insurance. Term insurance can help protect your beneficiaries against financial loss resulting from your death; it pays the face amount of the policy, but only provides protection for a definite, but limited, amount of time. Term policies do not build cash values and the maximum term period is usually 30 years. Term policies are useful when there is a limited time needed for protection and when the dollars available for coverage are limited. The premiums for these types of policies are significantly lower than the costs for whole life. They also (initially) provide more insurance protection per dollar spent than any form of permanent policies. Unfortunately, the cost of premiums increases as the policy owner gets older and as the end of the specified term nears.

Term polices can have some variations, including, but not limited to:

Annual Renewable and Convertible Term: This policy provides protection for one year, but allows the insured to renew the policy for successive periods thereafter, but at higher premiums without having to furnish evidence of insurability. These policies may also be converted into whole life policies without any additional underwriting.

Level Term: This policy has an initial guaranteed premium level for specified periods; the longer the guarantee, the greater the cost to the buyer (but usually still far more affordable than permanent policies). These policies may be renewed after the guarantee period, but the premiums do increase as the insured gets older.

Decreasing Term: This policy has a level premium, but the amount of the death benefit decreases with time. This is often used in conjunction with mortgage debt protection.

Many term life insurance policies have major features that provide additional flexibility for the insured/policyholder. A renew-ability feature, perhaps the most important feature associated with term policies, guarantees that the insured can renew the policy for a limited number of years (ie. a term between 5 and 30 years) based on attained age. Convertibility provisions permit the policy owner to exchange a term contract for permanent coverage within a specific time frame without providing additional evidence of insurability.

Food for Thought

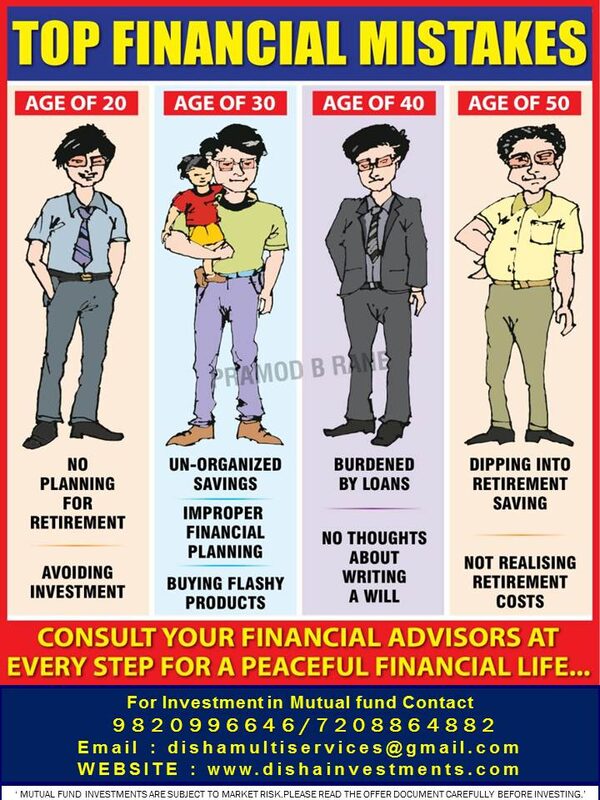

Many insurance consumers only need to replace their income until they've reached retirement age, have accumulated a fair amount of wealth, or their dependents are old enough to take care of themselves. When evaluating life insurance policies for you and your family, you must carefully consider the purchase of temporary versus permanent coverage. As you have just read, there are many differences in how policies may be structured and how death benefits are determined. There are also vast differences in their pricing and in the duration of life insurance protection.

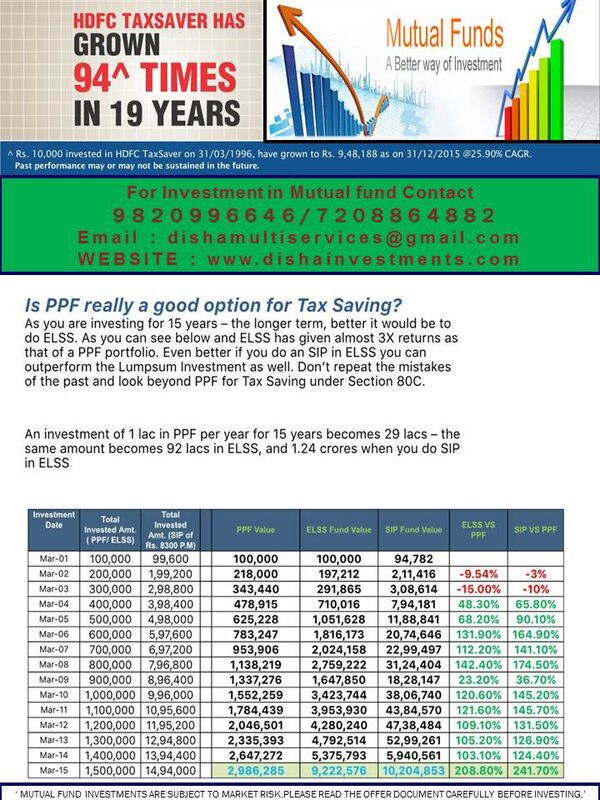

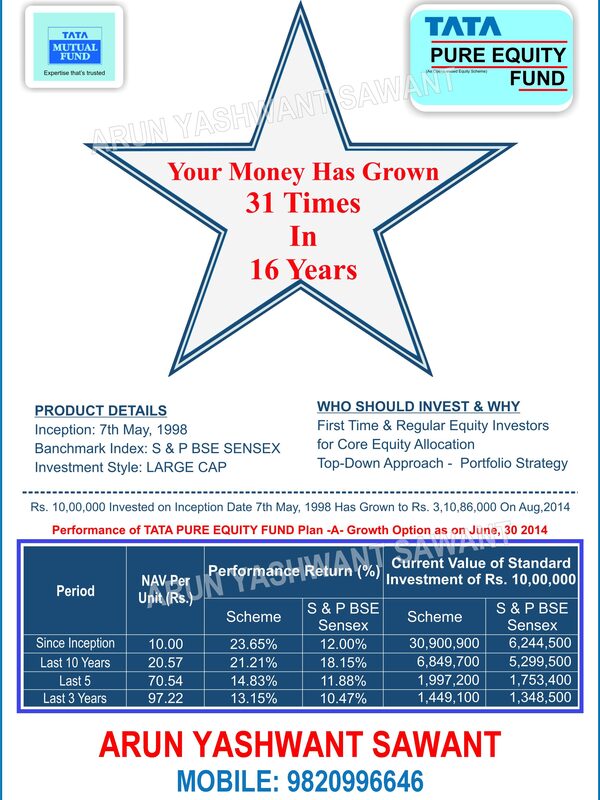

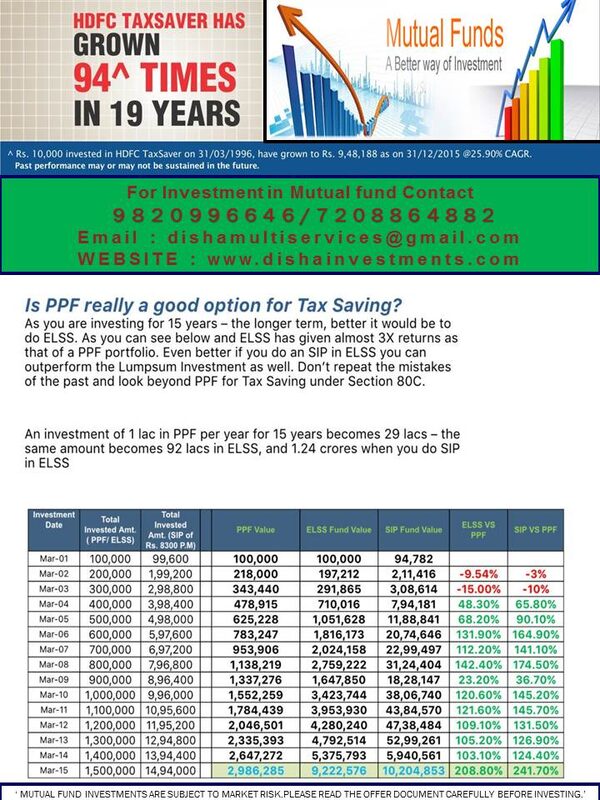

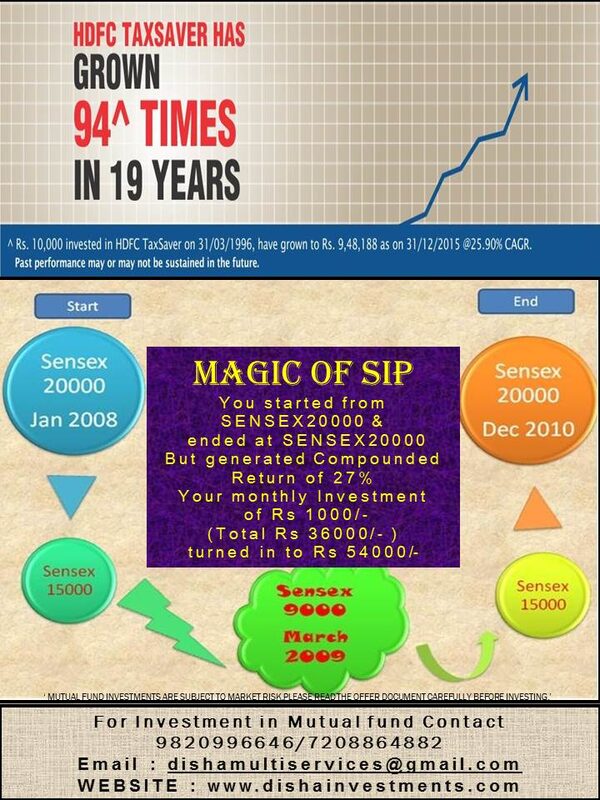

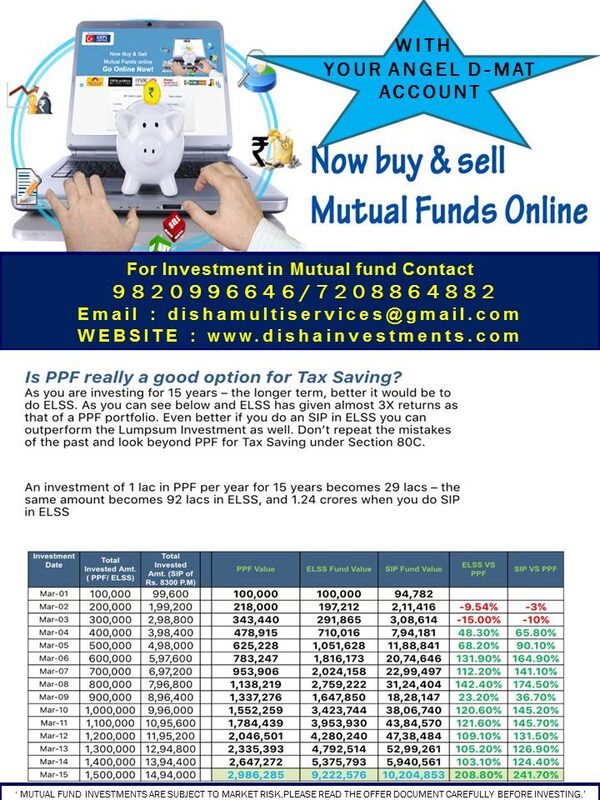

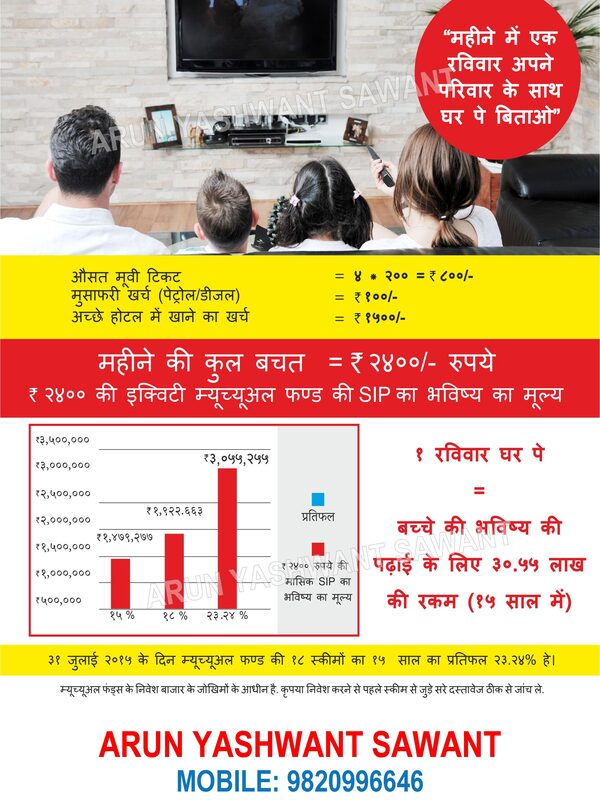

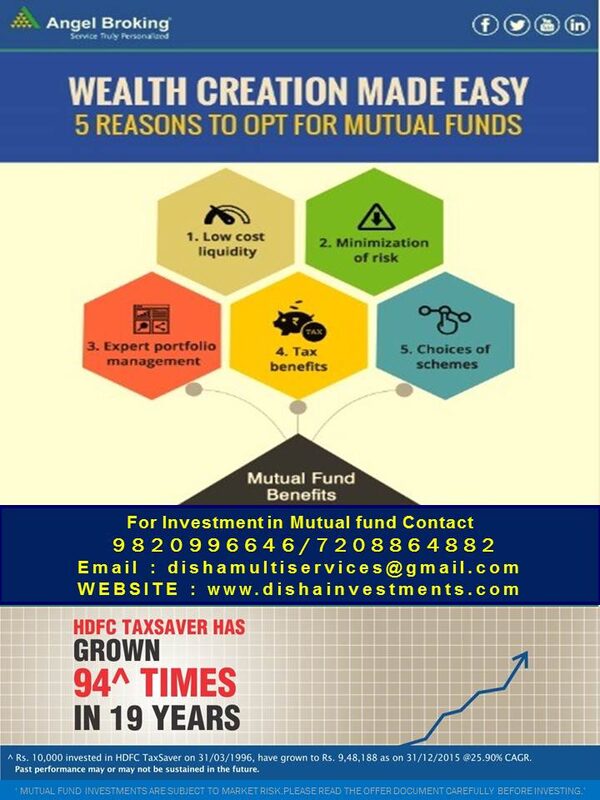

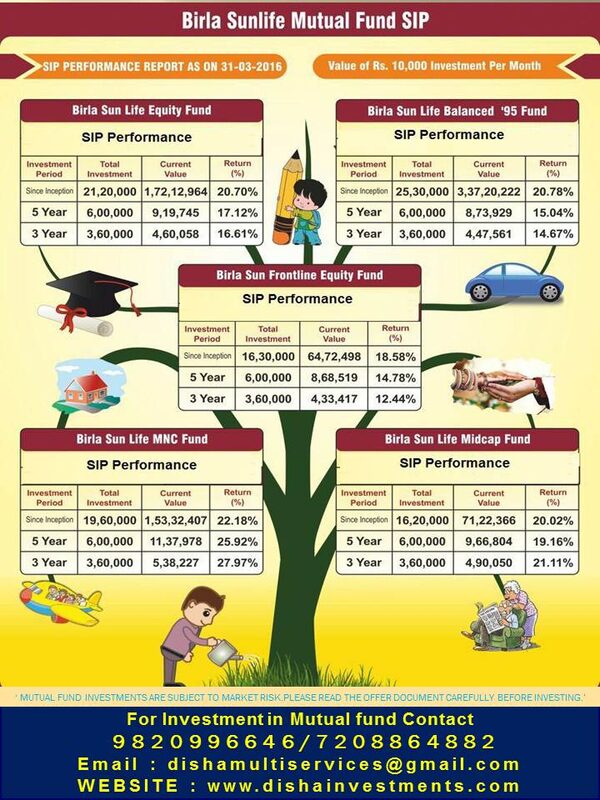

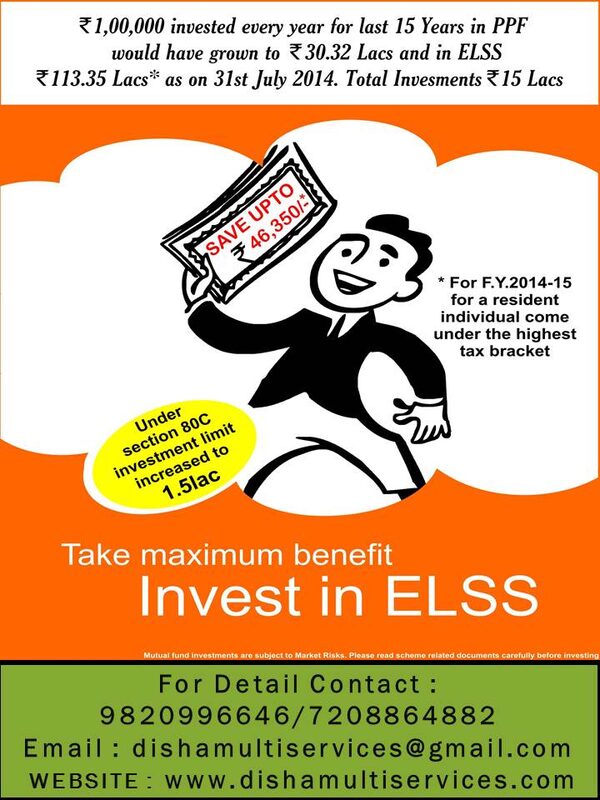

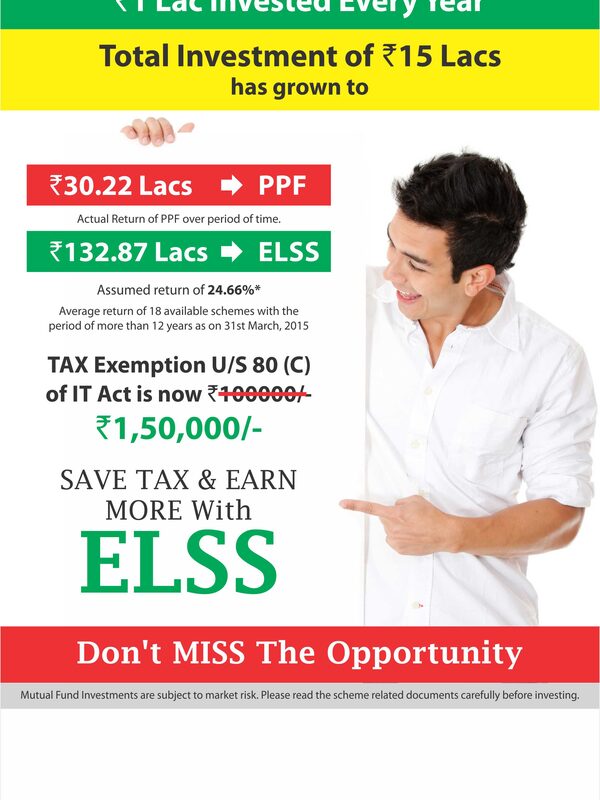

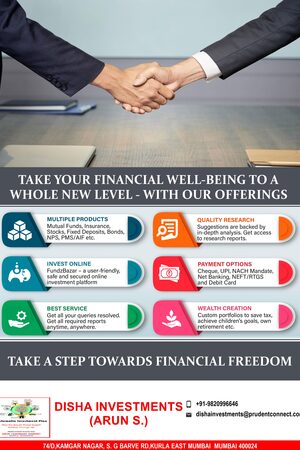

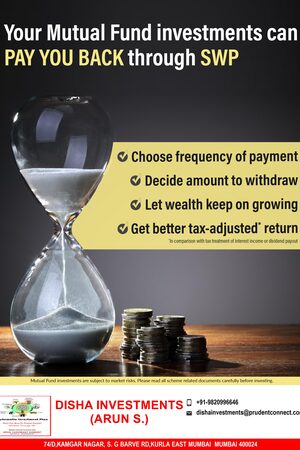

Many consumers opt to buy term insurance as a temporary risk protection and then invest the savings (the difference between the cost of term and what they would have paid for permanent coverage) into an alternative investment, such as a brokerage account, mutual fund or retirement plan.